Registering Foreign Judgments

With the advancement of technology has come ease in trading and offering services worldwide.

In light of this global community, there are real benefits in registering foreign judgments in Australia (and vice versa) as the judgment creditor will not have to initiate proceedings and incur the risk, cost and delay associated with the usual court process in an attempt to replicate a result they have already achieved overseas.

Since 1991, judgments of certain foreign countries have been capable of being registered and enforced in Australia. This is available where the foreign jurisdiction offers ‘reciprocity of treatment’ to Australian judgments; in other words, they will also enforce an Australian judgment.

Registering a judgment in other jurisdictions in which the judgment debtor operates will provide a more convenient method of enforcing the judgment and recovering any amount owing quickly and efficiently.

Registering foreign judgments in Australia

The applicable legislation and regulations are the:

- Foreign Judgments Act 1991 (Cth) (Act) as well as the Foreign Judgments Regulations 1992 (Cth) (Regulations) (which relate only to a specified list of countries); and

- Trans-Tasman Proceedings Act 2010 (Cth) (Trans-Tasman Act) as well as the Trans-Tasman Proceedings Regulation 2012 (Cth) (Trans-Tasman Regulation) (which relates only to registering New Zealand judgments).

Not all foreign judgments can be registered in Australia. To be eligible for registration, the judgment must have been made in a court specified by the Regulations. Currently, judgments from ‘superior’ courts in 35 different jurisdictions can be registered in Australia under the Regulations. Judgments from ‘inferior’ courts (as defined in the Regulations) can only be registered in Australia if they come from the United Kingdom, Canada, Switzerland or Poland.

To be registrable in Australia the judgment must be:

- a money judgment;

- an eligible non-money judgment;

- final and conclusive; and

- given in an eligible superior or inferior court of a specified country.

For the purposes of section 5 of the Act, a judgment is considered ‘final and conclusive’ even if:

- an appeal is in progress; or

- the judgment may be subject to an appeal.

A ‘money judgment’ (a ‘judgment under which money is payable’, such as a final award for damages or costs), can be claimed in either the currency of the foreign judgment or the equivalent amount in Australian dollars. Generally, criminal and family law judgments are not eligible for registration in Australia.

Foreign Judgments Act

1. Jurisdiction

Section 6 of the Act sets out which Australian courts hold the appropriate jurisdiction to register the foreign judgment. This will usually be the Supreme Court of a state or territory, although certain judgments will be more appropriately dealt with by the Federal Court.

2. Process

A foreign judgment may be registered in Australia within six years of the date on which it was given. In exceptional circumstances, an extension of time may be available.

Applications are typically made without need to notify the other party of the proceeding (‘ex parte’). This is beneficial, as the party liable under the judgment (commonly referred to as the judgment debtor) will not be notified of the application. However, the party seeking to register the foreign judgment must provide full disclosure of all relevant matters to the Court (including issues and matters that might be detrimental to the success of the application). There are also grounds in the Act for the judgment debtor to apply to court to have the judgment set aside.

A judgment will not be registered if:

- it has been wholly satisfied (for example, the judgment debtor has paid most or all of the amounts owing); or

- it could not be enforced in the country of the original court.

Once registered, the judgment has the same force and effect as it would have if it had been made in Australia. This means that:

- steps may be taken to appoint a liquidator (if the judgment debtor is an Australian company or carries on business in Australia);

- a garnishee order may be obtained (an order seizing funds or income of the judgment debtor);

- action can be taken against assets owned by the judgment debtor in Australia;

- the judgment carries interest; and

- the registering court has the same control over the enforcement of the registered judgment as it would otherwise.

Once registered, the ordinary Australian limitation period (usually 15 years) will then apply to enforcing the judgment debt as ordinarily occurs for judgments made in Australia.

Trans-Tasman Act

The Trans-Tasman Act regulates registering New Zealand judgments in Australia (as well as other matters).

Similar to the foreign judgments discussed above, a New Zealand judgment can only be registered if it is final and conclusive. A judgment given in a criminal proceeding can also be registered in Australia, provided the judgment consists wholly of a requirement to pay money. Judgments relating to probate, or the estate of a deceased person as well as guardianship and care, or welfare of a child (among others) are not capable of registration in Australia.

The judgment can be registered in its totality or, if parts of the judgment are not registrable, only the parts which are eligible for registration in Australia.

Registering Australian judgments overseas pursuant to the Act and Trans-Tasman Act

Given the Act and the Trans-Tasman Act require reciprocity of treatment, Australian judgments are capable of registration in both New Zealand and all jurisdictions listed in the Regulations.

The process for registration would depend on the court’s rules in the relevant foreign jurisdiction.

When registering a foreign judgment in Australia, or when registering an Australian judgment overseas, the original judgment should be relied upon (as opposed to a judgment of another jurisdiction merely registering the original judgment).

Registering foreign judgments not subject to the Act and the Trans-Tasman Act

Notwithstanding the fact that a country may not provide reciprocal treatment of Australian judgments subject to the Act, an Australian judgment may still be capable of being registered in other foreign jurisdictions, and vice versa (although, the process is considered more cumbersome and costly than judgments from a country subject to the Act or Trans-Tasman Act).

By way of example, an Australian money judgment is capable of being registered in some states in the United States (regulated by the Uniform Foreign-Country Money Judgments Act) provided that:

- the judgment is final and conclusive (as with the Act and Trans-Tasman Act);

- the court in which the judgment was made follows similar rules and procedures as the United States with a focus on due process of law (Australian courts are likely to meet this test); and

- the United States court must have jurisdiction over the judgment debtor.

The court still has the discretion to reject the application even if the above criteria have been met.

Similarly, judgments of some countries not subject to the Act or Trans-Tasman Act can be registered in Australia. To register a foreign judgment of this type in Australia, an application must be made pursuant to the court’s common law jurisdiction.

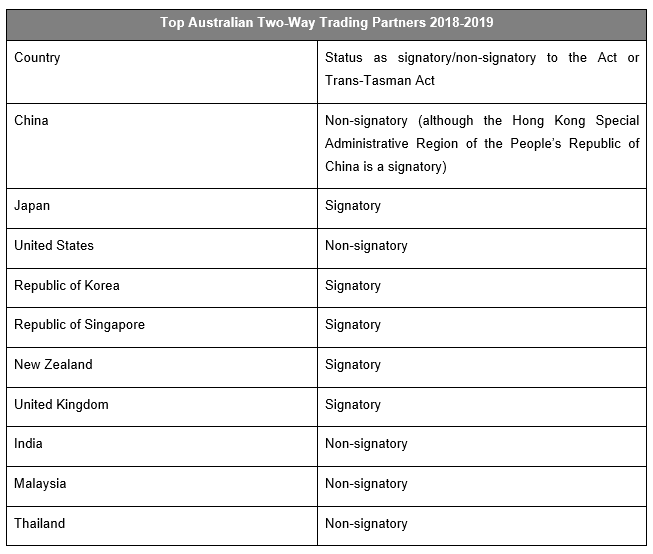

Overall, although it is not impossible to register an Australian judgment in a jurisdiction not listed in the Act or the Trans-Tasman Act and vice-versa, the process will likely be protracted and costly in comparison to registering a judgment in one of the specified countries in the Regulations. A list of Australia’s top ten two-way trading partners and their current status as a signatory or non-signatory is listed below.

*Australia’s top ten two-way trading partners according to the Department of Foreign Affairs and Trade’s published document entitled ‘Trade and Investment at a Glance 2020′.

Queries

Cornwalls has a large international network that can assist in registering foreign judgments here as well as Australian judgments overseas. If you have any questions about this article, please get in touch with an author or a member of our Litigation & Dispute Resolution team.

Disclaimer

This information and the contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders, and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.