More change is coming… Phase 2A of Queensland’s project trust regime on the horizon

On 1 July 2021, the next phase of the implementation of the requirement for head contractors to establish Project Trust Accounts (PTAs) and Retention Trust Accounts (RTAs) on Queensland projects commences.

Phase 1 of the PTA rollout is currently in effect and commenced on 1 March 2021. Last year, we flagged this introduction of the new project trust regime (see the full article here).

The commencement of the new phase will require head contractors to establish a PTA on a broader range of State Government and Hospital and Health Service projects than before by removing the previous $10 million valuation ceiling, making the scheme now apply to larger projects.

Over these five major phases, the framework progressively expands to capture more projects and contractors. PTAs will soon be required on most private and public sector commercial construction projects in Queensland valued at over $1 million.

Who is required to establish trusts?

- For Project Trust accounts, the contracted party for the contract that required the Project Trust is responsible for establishing and maintaining the trust (generally the Head Contractor). They are the Trustee.

- For Retention Trust accounts, the contracting party who is withholding retentions from the contracted party’s/parties’ payments is responsible for establishing and maintaining the trust. They are the Trustee.

Initially, the trustee will, in most cases, be the Head Contractor. However, as Retention Trusts are progressively expanded to cover more projects, the trustees may also be the Principal or a Subcontractor that holds cash retentions from its Sub-subcontractors.

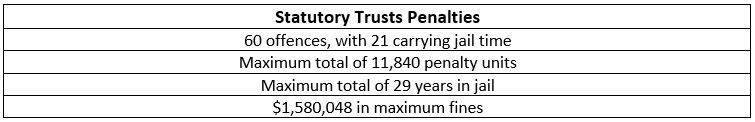

Potential penalties

There are many penalties specified throughout the legislation for non-compliance with various aspects of the trusts regime ranging from small fines to large fines or imprisonment.

Like all substantial and far-reaching legislation, until it is fully implemented and ‘tested’ by parties, there are numerous issues that will only be revealed over time.

Unfortunately, there will be parties who deliberately look to avoid their obligations.

Other parties may seek to minimise the impact on their operations by exploring questionable contractual and financial options.

There will be other parties who will genuinely struggle to come to terms with their new responsibilities.

If you haven’t already, now is a critical time to be aware of the commencement of the new phase of the regime, and consider how it will impact your current financial and project administration procedures.

If you need any assistance in understanding your obligations under the new regime, please contact Cornwalls Brisbane. We have considerable knowledge of Queensland’s legislative landscape and can assist with any concerns you may have.

Queries

If you have any questions about this article please get in touch with the author or a member of our Building & Construction team.

Disclaimer

This information and the contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders, and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.