End of Financial Year Guide 2020

Effective planning and preparation is critical for all taxpayers as the end of financial year approaches. This guide sets out various items which should be considered prior to 30 June 2020 in order to ensure that every taxpayer’s tax affairs are in order. This document is intended to be used only as a guide and does not contain comprehensive legal advice.

1. Individuals

Individual income tax rate thresholds and residency rules:

(a) In determining which taxation rates will apply to individual taxpayers, a distinction is made between residents and prescribed non-residents. For the purposes of being taxed as an Australian resident, an individual will be regarded as being an Australian tax resident if, at any time during the income year:

- the person was a resident of Australia; or

- the individual was in receipt of a taxable Australian social security, military rehabilitation or veterans’ entitlement pension, benefit or compensation.

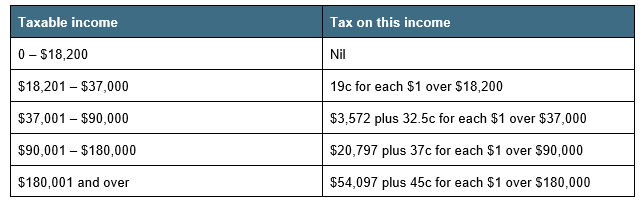

The applicable income tax rates for Australian residents for the year ended 2019/20 are as follows:

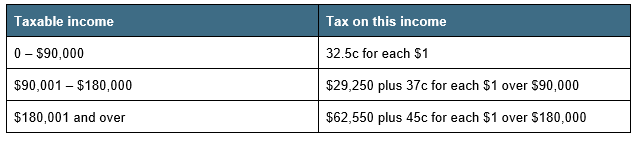

The applicable income tax rates for non-resident individuals for the year ended 2019/20 are as follows:

2. Superannuation

(a) Quarterly superannuation contributions

The purpose of the superannuation guarantee is to ensure employers provide sufficient superannuation support for their employees. For the quarterly period of 1 April to 30 June 2020, Superannuation Guarantee Contributions (SGC) must be paid by 28 July 2020. To qualify for a tax deduction in the 2020/21 financial year, contributions must be paid by the quarterly due date.

(b) Superannuation guarantee and contractors

Employers are required to ensure that they make proper contributions for all eligible employees, including independent contractors for SGC purposes. Where an employer engages contractors, the required applicable contracts should be reviewed in order to determine whether the employees are treated as employees for SGC purposes.

(c) Contribution limits

Contributions to superannuation are capped for individuals regardless of whether that contribution is made by them or by their employer. The caps are as follows:

- The concessional contribution cap is $25,000 (which includes superannuation guarantee paid for by an employer, personal contributions and salary sacrificed amounts).

- The non-concessional contributions cap is $100,000. This threshold will remain available to individuals aged between 65 and 74 years of age if they meet the work test.

(d) Early release of superannuation – response to COVID-19

Eligible Australian citizens and permanent residents can apply for up to $10,000.00 to be released from their superannuation for the 2019/20 financial year, and can apply again for a further release of $10,000.00 from their superannuation for the 2020/21 financial year.

In order to be eligible for this benefit, one of the following must be satisfied:

- you are unemployed; or

- you are eligible to receive one of the following payments:

- JobSeeker payment;

- youth allowance for job seekers;

- parenting payment

- special benefit (ie payment as a result of severe financial hardship administered by Services Australia); or

- farm household allowance, or

- on or after 1 January 2020, either:

- you were made redundant; or

- your working hours were reduced by 20% or more; or

- you were a sole trader and your business was suspended or there was a reduction in turnover of 20% or more.

(e) Temporarily reducing superannuation minimum payment amounts – response to COVID-19

As a result of COVID-19, the Government has temporarily reduced superannuation minimum payment amounts to retirees from their superannuation fund. The minimum annual payment has been reduced by 50% to members of account-based pensions and annuities, allocated pensions and annuities, and market-linked pensions and annuities for the 2019/20 and 2020/21 financial years.

3. Main Residence Exemption from CGT – Foreign Tax Residents

As of 12 December 2019, the rules in relation to the main residence exemption from CGT for foreign tax residents have changed. Previously, Australian tax residents and foreign tax residents were entitled to a CGT exemption where they lived in a property that was their principal place of residence. These new changes will affect individuals who will be selling their main residence in Australia while being a non-tax resident (ie, those who are already overseas).

This new law will apply to:

- property acquired prior to 9 May 2017, which is disposed of on or after 1 July 2020; and

- property acquired on or after 9 May 2017.

Property that was acquired prior to 9 May 2017 and disposed of on or before 30 June 2020, will be subject to the previous CGT regime.

The new law states that if you are a foreign tax resident at the time you dispose of your residential property in Australia, you will not qualify for the main residence exemption – unless you can satisfy the life events test.

A foreign tax resident will satisfy the life events test at the time that the property is disposed of, provided:

- you were a foreign tax resident for a continuous period of 6 years or less, and during that time, one of the events below occurred:

- you, or your spouse or child (under the age of 18), had a terminal medical condition;

- your spouse or child has died; or

- a divorce, separation or similar maintenance agreements have been entered into, resulting in a CGT event which involved the distribution of assets between you and your spouse.

4. Deductions

In response to COVID-19, work arrangements may have changed for many individuals. If you have been working from home, you may be able to claim some deductions for expenses incurred.

The calculation method used to calculate home office expenses is dependent on each employee’s circumstances. The following can be used as calculation methods:

- shortcut method (only available between 1 March 2020 and 30 June 2020);

- fixed rate method; and

- actual cost method.

(a) Shortcut method – COVID-19 response

The shortcut method allows you to deduct 80 cents for each hour that you have worked from home, provided:

- you are actively working from home (ie fulfilling your employment duties); and

- you have incurred additional running expenses as a result of working from home.

Should you use the shortcut method, it is important to note that you cannot claim any other expenses for working from home for the 1 March 2020 to 30 June 2020 period. It is also necessary that you keep a timesheet or a diary to document the hours you worked each day from home.

(b) Fixed rate method

The fixed rate method enables you to deduct 52 cents for each hour that you have worked from home. In order to use this deduction method, you must have a dedicated work area/study in your home.

This method covers expenses in relation to:

- the decline in value of home office furniture;

- electricity and gas; and

- the cost of repairs to any home office equipment, furniture or furnishings.

You must ensure that you keep records to document the hours you have spent working from home for the financial year.

You can also claim the work-related portion of your phone expense, internet expense, stationery expense and decline in value of equipment for phones and computers, in addition to the 52 cents per hour.

(c) Actual cost method

As an alternative to the fixed rate method, the actual cost method can be used to claim deductions that you directly incur as a result of working from home. In comparison to the fixed rate and shortcut method, the actual cost method is not capped at a cents-per-hour rate. The actual cost method requires detailed records in order to substantiate these deductions.

The Australian Taxation Office (ATO) website provides various detailed ways to document the work-related portion of your expenses. If you are going to use the actual cost method, it is recommended that you review the types of records that the ATO recommends you keep in order to substantiate the deductions.

5. Small Businesses

From 1 July 2016, the small business turnover threshold increased from $2 million to $10 million.

However, it is important to note that the threshold for the small business CGT concessions remains at either a $2 million turnover or a $6 million net asset test.

6. Small Business Company Tax Rate

The company tax rate remains at 30% for companies that have more than 90% passive income or for companies with a turnover of more than $50 million in 2020.

Smaller taxpayers with a turnover of less than $50 million and less than 80% passive income will qualify for the reduced company tax rate of 27.5%.

For the 2020/21 year, the reduced company tax rate for small taxpayers will be 26%, where their turnover is less than $50 million and less than 80% passive income. For all other companies, the company tax rate remains at 30%.

(a) Franking account

It is important to ensure that a company’s dividend payments and franking profile are reviewed prior to financial year end, in order to determine whether there are sufficient franking credits for any planned dividend.

Generally, the maximum franking credit allocated to a franked distribution is based on the company’s tax rate. Where a company qualifies for the 27.5% company tax rate, the company will also have a 27.5% corporate franking tax rate. This will occur provided the company turnover for 30 June 2019 is less than $50 million and the base rate entity passive income test based on its 30 June 2019 income is satisfied.

(b) Top-up tax

Where there are companies that pay 27.5% franked dividends, the shareholders will be required to pay a higher top-up tax because the franking offset received will be lower than if the dividend were franked at 30%.

7. Income and Timing

The basis upon which taxpayers account for income and expenses will affect their income tax liabilities for the income year ended 30 June 2020. These two methods are:

- Cash basis – income will be derived in the relevant period that it has been received and expenses are incurred in the relevant period in which the liability arises (ie interest, dividends, rent).

- Accruals basis – income and expenses are recognised on receipt of an invoice or bill, although they may not yet be due for payment (ie generally for trading income or other business income that relies on circulating capital, or staff or equipment to produce income).

A taxpayer will need to determine whether any income earned (or expenses incurred) is on a cash basis or accruals basis, because this will affect whether amounts are assessable (or deductible) in the income year ended 30 June 2020 or in the following income year.

8. Deductions

A general deduction can be claimed for expenses incurred in the earning of assessable income or the carrying on of a business for the purpose of earning assessable income. Certain deductions may also be available for certain types of expenses specifically provided for in income tax law.

Deductions are not available for expenses that are:

- unrelated to the earning of assessable income;

- capital in nature;

- private in nature; and

- incurred in earning exempt income.

(a) Bad debts

A deduction for bad debts is allowable if the debt has been written off as a bad debt before the end of financial year (ie 30 June 2020), and an amount in respect of the bad debt has previously been included in the taxpayer’s assessable income.

(b) Black-hole expenditure

A deduction can be made for certain business capital expenditure on a straight-line basis over a 5 year period. This deduction only applies to capital costs incurred in relation to a past, present or proposed business that is not otherwise dealt with under income tax law.

A taxpayer may claim a deduction for a gift or donation made over the value of $2 to Deductible Gift Recipients (DGR). Donations must be made to deductible charities prior 30 June 2020. It is important to retain proof of the gift or donation in the event documentation is required to substantiate the claiming of a deduction.

It is important to note that where a benefit is received by the donor, donations are not deductible unless the contribution was made at an eligible fundraising event for a DGR and the contribution is more than $150.

(d) Trading stock

A deduction can be made for trading stock either on or before 30 June 2020. It is important to consider an appropriate valuation method when valuing trading stock. A choice can be made between cost, market selling value or replacement price. Where a taxpayer is a small business entity, a stock valuation is not required if the difference between the opening and estimated closing value of trading stock is $5,000 or less.

(e) Small business write off

An immediate deduction is available for a low-cost asset in the income year in which it was first used or installed ready for use for a taxable purpose.

In order to qualify for the instant asset write off, if assets were purchased after 7.30pm (AEST) on 12 May 2015 and first used or installed ready for use:

- from 7.30pm (AEST) on 12 May 2015 until 28 January 2019, you can immediately deduct the business portion of most depreciating assets costing less than $20,000;

- from 29 January 2019 until before 7.30pm (AEDT) 2 April 2019, you can immediately deduct the business portion of most depreciating assets costing less than $25,000;

- from after 7:30pm (AEDT) 2 April 2019 until 11 March 2020, you can immediately deduct the business portion of most depreciating assets costing less than $30,000; and

- from 12 March 2020 until 31 December 2020, you can immediately deduct the business portion of most depreciating assets costing less than $150,000.

(f) Accelerated depreciation

Businesses with a turnover of less than $500 million will be entitled to the following deductions on eligible assets purchased and first used (or installed ready for use) between 12 March 2020 and 30 June 2021:

- immediate deduction for 50% of the cost of the asset in the year purchased, where the asset is valued at more than $150,000 (where it is valued at less than $150,000, then an immediate deduction for the full cost of the asset); and

- the balance of the depreciated amounts would be claimed under ordinary depreciation rules.

For small businesses that use a general pool, a claim can be made of 57.5% of the value of the equipment in the year purchased.

(g) Similar Business Test

A company can deduct its tax losses if it maintains the same underlying majority owners. Alternatively, a company that fails to maintain continuity of majority ownership will be able to deduct its losses if it can satisfy the Similar Business Test (SBT). Generally, a company will satisfy the SBT if it carries on the same business in the income year in which it seeks to utilise its loss as it had carried on immediately before the change of ownership. A company will not be able to satisfy the SBT if it meets certain ‘negative tests’.

9. COVID-19 Support

(a) JobKeeper Program

As part of the COVID-19 relief efforts introduced by the Federal Government, eligible employers whose GST turnover has declined by certain amounts can apply to the ATO for a subsidy of $1,500 per fortnight for each eligible employee for fortnights commencing on 30 March 2020 and ending on or before 27 September 2020.

To be eligible, the business’ GST turnover for a current period must have declined by:

- 30% where GST turnover is less than $1 billion; or

- 50% where GST turnover is more than $1 billion,

in comparison to the corresponding period from the previous year (ie GST turnover for March 2020 compared to GST turnover for March 2019).

If your turnover periods cannot be appropriately comparable and you supply employee labour services to members of your consolidated group, the Commissioner of Taxation has provided a ‘modified basic test for group employer entities’ which can be applied.

(b) Cash flow boost

In response to COVID-19, the ATO is providing temporary cash flow boosts to support both not-for-profit and small to medium businesses (Eligible Businesses) during this time. In order to obtain the cash flow boost, Eligible Businesses must:

- have held an active Australian Business Number (ABN) on 12 March 2020;

- have an aggregated annual turnover of $50 million or less; and

- have made eligible payments to employees that the business has an obligation to withhold from (even if the withheld amount is $0).

This stimulus package is being administered in a staged approach, which will enable Eligible Businesses who employ staff to receive between $20,000.00 and $100,000.00 when lodging their business activity statements for the quarterly period from March to June or each monthly period.

Where Eligible Businesses are not required to withhold tax from salary and wages, they will still be entitled to receive a minimum credit of $10,000.00. This cash flow boost is to be received by Eligible Businesses as a credit in their activity statement system.

For quarterly lodgers, Eligible Businesses will be entitled to a maximum of $50,000.00 credit payable in late April 2020. The second eligible credit (up to a maximum of $50,000.00) will be payable in two instalments up to a maximum of $25,000.00 each in the June and September 2020 BAS lodgment periods.

For monthly lodgers, eligible businesses will be entitled to a maximum credit payable of $50,000.00 in late April 2020 (equivalent to 300% of their withheld wages for March). This initial boost received will then be received again in the form of the second eligible credit, but will be divided evenly over the lodgment periods of June 2020 to September 2020.

10. Superannuation guarantee Amnesty

A superannuation guarantee amnesty was introduced in March 2020 to enable employers to voluntarily disclose any amounts of unpaid or late superannuation guarantee payments. The amnesty ends on 7 September 2020.

This amnesty may allow employers to claim a tax deduction for any late superannuation payments, provided they relate to quarters beginning from 1 March 1992 to 1 January 2018 and are paid by the due date of 7 September 2020.

An additional benefit associated with the superannuation guarantee amnesty is that there are reduced penalties and administrative charges on late superannuation guarantee payments.

11. End of Financial Year Planning Points

(a) Division 7A – Loans from private companies

Directors need to ensure that Division 7A loans are properly documented in line with tax legislation.

Loans made by private companies to their shareholders or associates will be treated as deemed dividends under Division 7A unless the loan is repaid by the earlier of:

- the due date for lodgment of the company’s tax return for the year; or

- if it is converted into a complying loan by the company’s lodgment day for the income year in which the payment occurs, that lodgment day.

The Division 7A rules apply to shareholders and associates, and include relatives of shareholders and trusts, companies and partnerships of the shareholders of their associates.

Where Division 7A loans are in place, it is important to consider the following issues in relation to the loans:

- ensure the minimum loan repayment amounts are paid in the years after the loan is made;

- any shortfall between amounts paid and unpaid will result in a deemed dividend in that year;

- a deemed dividend (as a result of a Division 7A loan) is generally unfranked;

- payments and debt forgiveness to a shareholder or associate can also be characterised as a deemed dividend;

- the private use of company owned assets for less than market value consideration can be a deemed dividend; and

- where non-compliant loans resulted from an honest mistake or inadvertent omission, the Commissioner has the discretion to not characterise benefits as deemed dividends or franked dividends.

(b) Division 7A – Unpaid trust distributions

Any unpaid trust distributions made by trusts to associated private companies may be deemed to be a loan to the trust and become subject to Division 7A.

For the 2020 financial year, unpaid distributions to a private company that occurred in the 2020 financial year, may be a deemed dividend to the trust for the current year, except where the trustee:

- has put the amount in a sub-trust for the exclusive benefit of the private company by the earlier of the lodgment date or due date for lodgment of the trust’s 2020 tax return;

- converts the amount to a Division 7A complying loan by the earlier of the lodgment date or the due date for lodgment of the 2020 company tax return; or

- pays the amount to the company by the earlier of the lodgment date or the due date for lodgment of the company’s 2020 tax return.

For unpaid distributions that have been placed into a sub-trust, the annual return on the sub-trust investment must be paid to the private company by 30 June 2020.

12. Payment of Dividends – Companies

Company distributions to shareholders will be regarded as dividends, so long as they do not arise from the share capital of the company.

If a dividend is paid by a company, the company must provide a dividend statement to the shareholder. If the company is a private company, the dividend statement must be provided to the shareholder within four months of the end of the income year (by 31 October 2020). Where the company is a public company, the dividend statement must be provided on or before the date that the dividend is paid.

13. Trusts

(a) Tax on trust distributions

As a general rule, the trustee of a trust is liable for tax on amounts of income from a trust estate to which no beneficiary is presently entitled. It is important to ensure that individual or corporate beneficiaries are made presently entitled to the income of a trust estate to reduce the tax payable on trust distributions before the end of financial year.

(b) Trust streaming

Trust streaming rules allow the trustees to stream franked dividends and capital gains to specific beneficiaries, rather than distributing these amounts as part of the general distribution to beneficiaries.

In order to stream franked dividends and capital gains, the trust deed must specifically allow the trustee to stream particular classes of income to specific beneficiaries.

Beneficiaries who are to receive these amounts must be specifically entitled to them. Further, the trustee must record the streamed distributions in the records of the trust.

The trustee’s distribution resolution in favour of the specifically entitled beneficiary would generally be sufficient for this purpose.

The trustee must ensure that the following are recorded by the required dates:

- franked dividend streaming – 30 June 2020;

- capital gain streaming – 31 August 2020.

However, where capital gains are included in the income of the trust, the trust deed generally requires the trustee’s distribution determination to be made either on or before 30 June 2020.

(c) Trust distributions and resolutions

Most trust deeds for discretionary trusts require trustees to make their distribution determination for the year ended either on or before 30 June 2020.

The ATO expects evidence, preferably written, of the trustees making determinations in accordance with their trust deeds by the date specified in the trust deed.

14. International Tax

(a) Thin capitalisation

The thin capitalisation rules provide that payments of large sums of interest to overseas companies for financial accommodation provided to their Australian subsidiaries are not allowable deductions in the hands of the Australian subsidiary. The rules apply to Australian entities investing overseas, their associate entities, foreign controlled Australian entities and foreign entities investing directly into Australia.

Taxpayers should examine their debt to equity ratios with reference to the ‘safe harbour’ ratio and consider whether it is appropriate to implement strategies to alter their current ratio (eg capital injection, asset revaluation) to fall within the ‘safe harbour’ levels. Taxpayers must consider whether any strategy to alter their debt to equity ratios would contravene the relevant integrity provisions.

(b) International Dealings Schedule

If your business is engaged in international dealings with related parties, and has more than $2 million of related-party dealings, you are required to complete an International Dealings Schedule (IDS) and lodge it with your tax return for the financial year. It is important to review the 2019/20 IDS as there have been changes made to the types of information which are required to be disclosed.

15. ATO Audit List

Every year the ATO releases a list of areas that it will be focusing its compliance resources on at the end of every financial year. For the financial year ended 30 June 2020, the ATO will be paying close attention to the following deductions:

- claims for work-related clothing, dry cleaning and laundry expenses;

- home office use (including claiming for ‘occupation’ costs like rent and rates);

- overtime meal claims;

- union fees and subscriptions;

- mobile phone and internet costs, with a particular focus on people who are claiming the whole (or a substantial part) of the bill for their personal mobile as work-related;

- motor vehicle claims where taxpayers take advantage of the 68 cents per kilometre flat rate available for journeys of up to 5,000kms;

- incorrectly claiming deductions under the rule that allows taxpayers who have incurred work-related expenses of $300 or less in total to make a claim without receipts; and

- property-related deductions (ie excessive interest expense claims, incorrect apportionment of rental income and expenses between owners and rental homes that are not genuinely available for rent).

The various support packages released by the Federal Government in response to COVID-19 (ie JobKeeper payments, cash flow boosts, early release of superannuation) will also be closely monitored by the ATO, especially in relation to Part IVA, the anti-avoidance rules.