FTX and Sam Bankman-Fried: A Case Study in Professional Scepticism and Fraud Detection

Late last year, FTX, the cryptocurrency exchange recently valued at $US32 billion, filed for bankruptcy protection in the US. Its CEO, Sam Bankman-Fried was arrested in the Bahamas and is facing fraud charges.

The events leading up to the collapse of FTX illustrate the importance of auditors, accountants, financial, and legal advisors continuing to maintain a healthy dose of scepticism in the face of facts that present as being just a bit off.

A little over a year ago, Sam Bankman-Fried (‘SBF’) advised the media that if his cryptocurrency exchange platform FTX knocked out its competition, acquiring Goldman Sachs and Chicago Mercantile Exchange (CME) was “not out of the question”.

The statement was made in the thick of the crypto gold rush in 2020 and 2021 when governments flooded the markets with cash to stall the looming economic effects of COVID-19.

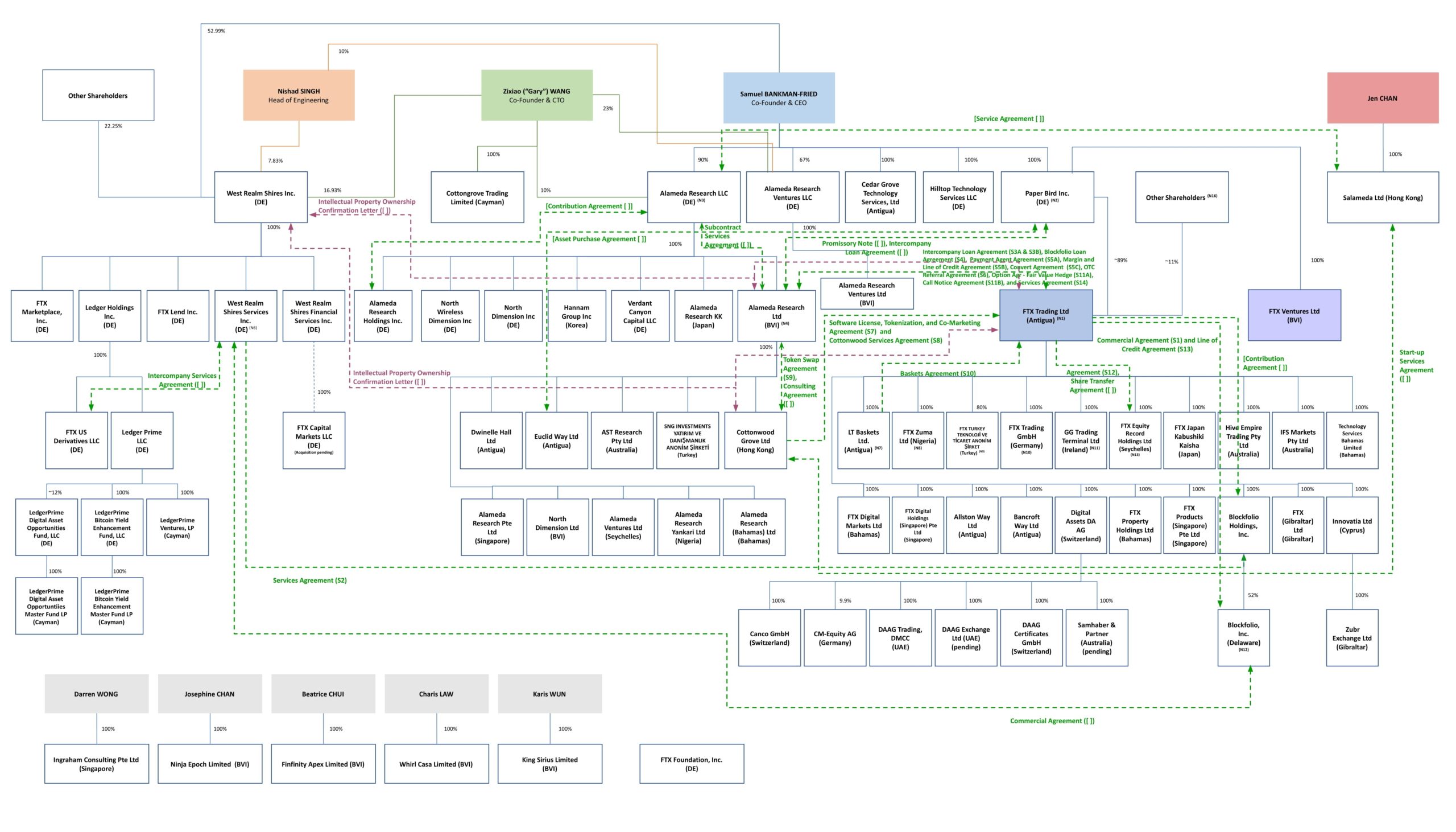

SBF was both the owner of FTX, the now-bankrupt crypto exchange, and Alameda Research, the now-bankrupt crypto hedge fund. Naturally, this is somewhat of an oversimplification; the Financial Times’ attempt at mapping the corporate structure as of March 2022 looks like any liquidator’s personal hellscape:

In November 2022, FTX’s new chief executive, John Jay Ray III, said in a bankruptcy filing that he had never seen “such a complete failure of corporate control.” Notably, Mr Ray has been involved in managing some of the largest corporate collapses in history, including Enron in the early 2000s.

The bankruptcy filing in early November 2022 by Mr Ray described numerous concerns, including the use of software to “conceal the misuse of customer funds.” Mr Ray also said that he could not trust the financial statements assembled under SBF’s leadership.

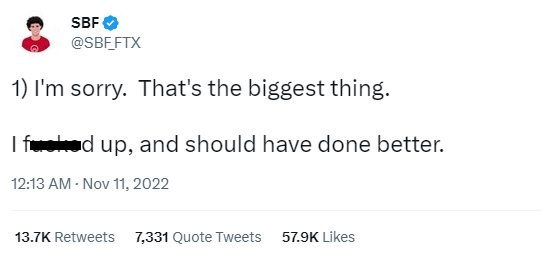

An interesting attempt at reparations was made when SBF posted a Twitter chain that began:

So what happened?

FTX and Alameda Research

On 2 November 2022, CoinDesk’s Ian Allison leaked that a significant portion of Alameda’s (the hedge fund) $14.6 billion assets were invested in a digital token called FTT (created by FTX).

In broad strokes, FTT was a created token that provided access to FTX’s trading platform and allowed users of FTX to pay for operations such as transaction fees. As a shorthand, FTT was to FTX what AUD is to Australia.

FTT tokens provide holders with a reduced cost for trading fees on FTX, among other benefits. However, like many cryptocurrency tokens, the value of FTT is based on perception and belief rather than any underlying tangible value.

The information in the CoinDesk leak, revealing the significant amount of funds invested in FTT, sparked inquiries about Alameda’s financial stability. There were concerns that a decrease in the token’s value could result in significant issues for both the trading company Alameda, and FTX.

On 6 November 2022, Binance (another crypto exchange platform) announced that it would sell its FTT tokens, which caused thousands of traders to try to offload their holdings. FTX, the trading platform, encountered a liquidity problem, faced with $6 billion worth of withdrawal requests over three days.

It’s since been alleged that SBF’s FTX had transferred billions to SBF’s Alameda Research to prop it up.

After an abandoned acquisition attempt of FTX by Binance, FTX filed for Chapter 11 bankruptcy protections in the US.

The aftermath continues, with Scott Langdon, John Mouawad and Rahul Goyal of KordaMentha Restructuring appointed as Voluntary Administrators of the cryptocurrency businesses FTX Express Pty Ltd and FTX Australia Pty Ltd on 11 November 2022.

The question arises – who could have seen this coming?

The CEO – Sam Bankman-Fried

Below is an extract of facts related to SBF. Consider yourself an auditor, accountant, or other advisor meeting your client who is eager to fund you to perform professional services.

- SBF was born in 1992. In 2017, when he was just 25, he founded Alameda Research LLC. Within months it reports as much as a million dollars per day in profit. Within a few more months, SBF sets up FTX Trading Ltd;

- A philanthropist at heart, SBF establishes himself as one of the biggest donors to causes such as malaria prevention, pandemic preparedness, and American political parties (both sides). It’s reported that FTX’s charity arm had, by the end of September 2022, committed more than $160 million to over 110 non-profit organisations.[1]

- In America, he is known for his hybrid Toyota Corolla, a wrinkled T-shirt, and New Balance sneakers. It is reported that once in the Bahamas, he leaves his Corolla for his private plane and travels to spend some $40 million on hotels, entertainment, and flights.[2]

But you’re not yet convinced by this client. You decide to do some research. Venture capital firm Sequoia Capital has published a lengthy and flattering magazine-style article on its website (which has since been deleted). You read about SBF’s meeting with Caroline Ellison, who would go on to become Alameda Research’s CEO, and SBF’s love interest:

“So,” Ellison asked after joining SBF at a table, “what have you been up to in the last few months?” Ellison, it should be noted, was dressed as a sultry wood nymph—she was on her way to a LARP (Live Action Role Play) party.

“Oh,” SBF responded cryptically, “I can’t tell you. It’s a secret.”

“Okay, that’s fine,” Ellison said, sipping her tea.

Uncomfortable silence.

“Well, I guess I could tell you if you really want…” SBF offered after a moment.

“Nope. It’s okay.” Sip.

An awkward beat later, SBF broke, slayed by the silent force of Ellison’s four-eyed gaze.

“I’ll just tell you,” he said.

Adam Fisher, the author of the Sequoia Capital article, continues by penning his musings about SBF:

As the success of FTX seems like a foregone conclusion, my interest gravitates to SBF the person. He’s like no other billionaire I’ve ever met, and I’ve hung out with quite a few. It’s like the brain of Spock has been transplanted into the shambolic body of Fozzie Bear. He’s a bit of both: instantly lovable—with the guilelessness, kindness, and openness of a Muppet—and so abstract that he seems more like a super-advanced AI than flesh and blood. I want to know what makes SBF so unusual, so, as we both pack up in the conference room (me coiling up the long cord that leads to my lapel mic, him folding up his laptop), I decide to just ask him about his evident weirdness directly.

“So, you are obviously what they call ‘neurodiverse,’ but you are not spectrum-y or Asperger-y,” I observe.

“No,” he agrees.

Further below in the article, Mr Fisher prods SBF about his interests and what makes him such a wonderkid:

Sensing an opportunity for connection, I chip in with my own two satoshi: “I don’t pay any attention to social media—not because I have any moral case against it,” I say, “but because, for me, reading books is the highest-bandwidth way I know to get quality information into my brain, which just craves the stimulation. I’m addicted to reading, which explains how I ended up being a writer.”

“Oh, yeah?” says SBF. “I would never read a book.”

The article turns its focus to the CEO of Alameda Research (the hedge fund tied to SBF), which is reported to hold some $14.6B assets as at June 2022:

Ellison is a freckle-faced redhead with a personality that splits the difference between bubbly and nerd-ball. She’s partial to a pair of designer frames that make her look a bit like Edna Mode, the superhero stylist in The Incredibles.

On the basis of this description, you decide to do further research into this C-suite executive. You decide to watch an interview hosted by El Momento.[3] Ms Ellison provides a fresh approach to the role of a CFO when asked whether she thinks she could have been able to perform in her role without her mathematics degree:

“… absolutely could pull it off without my math degree [laughs] use very little math, um, use a lot of like uh elementary school math like uh arithmetic, probability, uh but not really any of the advanced stuff…” [sic]

Her comments on risk management further intrigue you:

“… yeah we tend not to have things like stop losses, I think those aren’t necessarily a great risk management tool because uh they often sort of uh lead to you being closed our of your position in relatively low liquidity situations and losing to that uh kind of like exacerbating you know momentum from liquidations and things like that…[sic]

You decide that the personal relationship between SBF and Ms Ellison is irrelevant, even if the Sequoia Capital article does consider it important to disclose that Ms Ellison was at one point dressed “as a sultry wood nymph”.

It’s probably not a material consideration.

Professional scepticism – what is it?

Professional scepticism is an essential ingredient of the auditing process. It not only helps auditors (and other finance professionals) maintain objectivity and independence but also acts as a touchstone for reality.

In today’s complex business environment, auditors face numerous challenges, including potential conflicts of interest, management pressure, and the risk of fraud. Professional scepticism helps auditors to mitigate these risks by allowing them to remain impartial and assess the evidence objectively. This, in turn, increases the reliability of the audit results.

However, consigning responsibility for fraud detection entirely to a company’s auditors is a dangerous slope that starts at mere convenience and crosses into professional negligence, breaches of directors’ duties, and other breaches of the Corporations Act 2001 (Cth). After all, wilful blindness (a species of fraud)[4] may end up locking you out of cover from a professional indemnity insurer. At worst it results in criminal proceedings.

This article illustrates the bald-faced nonsense that can easily be brushed off by sophisticated actors: auditors, lawyers, financial advisors, and investors (retail, wholesale or otherwise). One can laugh at the bizarre nature of the FTX/Alameda collapse. However, it is a sobering thought to consider the sheer amount of investor funds that have been lost.

Ultimately, regardless of how strictly an auditing standard can be applied, sometimes the best approach is simply to think, well that’s more than a bit weird.

Queries

For further information regarding the above, please contact the author or any member of our Fintech, Privacy & Emerging Technologies or Litigation & Dispute Resolution teams.

Disclaimer

This information and the contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders, and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.

__________

[1] https://www.livemint.com/news/ftx-seeks-to-recover-donations-made-by-exchange-and-sam-bankmanfried-11673170300895.html

[2] https://fortune.com/crypto/2022/11/22/sbf-ftx-bahamas-house-lifestyle/

[3] https://www.youtube.com/watch?v=Qd2enI4RvXU

[4] Macquarie Bank v Sixty-Fourth Throne Pty Ltd [1998] 3 VR 133, 143.