Much more than just a token effort – the Australian Treasury’s crypto token mapping consultation paper is open for comment until 3 March 2023

Introduction

Regulators worldwide are wrestling with crypto. Australia is no exception. Australia was in the vanguard with the Australian Taxation Office’s release of a number of tax determinations concerning digital currency in 2014 and the Federal Senate Economics Reference Committee’s Report in August 2015 Digital Currency – Game Changer or Bit Player? Since then, there have been two crypto booms and two crypto winters. The technology has evolved in ways that could not have been predicted eight years ago, as have the business applications and the irrational exuberance of investors.

In March 2022, the Australian Treasury released a Consultation Paper on Crypto asset secondary service providers: Licensing and custody requirements. Broadly, this consultation paper canvassed ways to regulate digital currency exchanges and crypto custodians who administered or controlled crypto on behalf of others. Comments on that consultation paper were due by May 2022, by which time there had been a change in the Federal Government. Further work on that consultation was placed on hold; in August 2022, the incoming Federal Government announced that it would first prioritise “token mapping” work to help identify how crypto assets and related services should be regulated.

On 3 February 2023, the Australian Treasury released its Consultation Paper on Token Mapping. Interested parties have until 3 March 2023 to respond to the 14 consultation questions posed in the paper. The Consultation Paper is a closely reasoned and carefully written thought piece. Its usefulness will extend far beyond the consultation period. But when the consultation is complete, it remains to be seen whether what eventually emerges from the sausage-making assembly line* will strike an appropriate balance between innovation and consumer protection. It is up to industry, the regulators and consumer protection bodies to engage with the consultation questions from their respective perspectives as we progress towards enactment.

* The aphorism arguably mis-attributed to Bismarck is on the lines that “to retain respect for laws and sausages, one must not watch them in the making”.

What is token mapping?

The Australian Government views “token mapping” as “a foundational step in the Government’s multi-stage reform agenda that commits to developing appropriate regulatory settings for [the] crypto ecosystem in Australia.” According to the Australian Treasury, token mapping “is the process of identifying the key activities and functions of products in the crypto ecosystem and mapping them against existing regulatory frameworks.”

The Treasury’s token mapping exercise uses three key concepts to map the crypto ecosystem:

- Tokens – tokens are ‘physical or digital units of information that have a role in a token system’

- Token systems – a token system is ‘a collection of steps involved in performing a function’.

- Function – a function is the benefit that the token system is built to provide to the token holder.

For example, the Ethereum Blockchain is a token system that accepts ETH (a crypto token) to allow a customer to use the Ethereum Blockchain (the function).

Identifying the function of a crypto product in this way is fundamental to determining if that product is regulated as a financial product under the Australian financial services laws. This functional approach works well for Australia because, in general, Australian financial services laws regulate according to function, not technical form. Broadly, the order of analysis is as follows:

- Is the token system a “facility”? A facility is defined to include intangible property, a term of a contract, agreement, understanding, scheme, or other arrangement (whether or not wholly formal, written, implied or required by law, or legally enforceable).

- If yes, does the token system have the function of:

- making a financial investment;

- managing financial risk; or

- making non-cash payments?

- If the token system does not have any of the three general financial functions outlined above, is it nonetheless a financial product because it falls within one of the specific inclusions in the Australian Corporations Act?

High level taxonomy of crypto assets

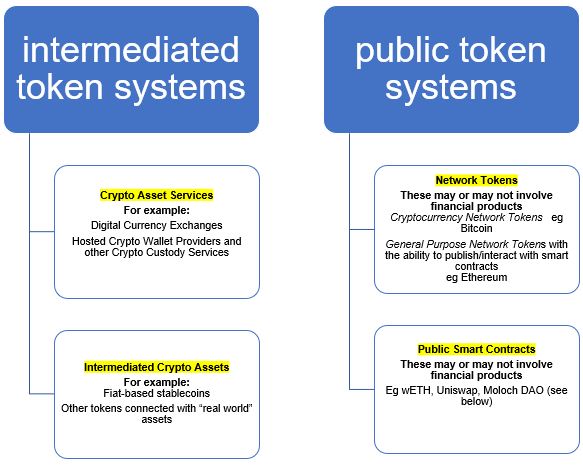

The Australian Treasury has used its function-based token mapping methodology develop the high-level taxonomy set out below. This taxonomy will result in activities involving crypto being regulated if (but only if) they fall within the financial product perimeter, as redrawn to accommodate crypto.

Why this particular taxonomy?

The Treasury’s proposed taxonomy appears to be driven by a desire to:

- link crypto regulation in a principled way with the existing structure of the regulation of financial products in Australia; and

- avoid crypto regulation based on a more extensive (but potentially less conceptually coherent) list of crypto categories that could give rise to:

-

- inconsistent regulatory treatment;

- co-mingled regulatory supervision responsibilities; and

- opportunities for domestic regulatory arbitrage.

More on public smart contracts

Public smart contracts are used to remove the need for an intermediary. As a result, they are distinct from the smart contracts which are used by an intermediary in providing a service involving an intermediated token system under the first limb of the Treasury’s proposed taxonomy.

The Treasury notes that “not all smart contracts on public crypto networks are public smart contracts” for the purposes of this taxonomy. For example, “a smart contract on a public crypto network can be fully intermediated and permissioned (e.g. usable only by authorised customers of a business) or fully intermediated but partly permissionless (e.g. a stablecoin that is freely transferable but that can be frozen by its issuer.)”

The Treasury gives these examples of public smart contracts:

- wETH: the publicly available, self-serve, “no counterparty” smart contract associated with “wrapped Ether” (wETH) which accepts ETH in exchange for wETH and accepts wETH in exchange for ETH.

- Uniswap: the publicly available, “self-serve” smart contracts associated with the Uniswap protocol which enables traders to swap crypto tokens against pools of liquidity provided by liquidity providers.

- Moloch DAO: the “Moloch DAO” type of smart contract protocol that enables users who do not know each other to make collective investments in crypto assets.

Key points

- Crypto asset services: These services comprise a large proportion of the existing crypto ecosystem. Key functions include fiat on/off ramping, crypto token trading, crypto custody and mining/staking as a service. Treasury foreshadows that it will release a separate consultation paper in mid-2023 on licensing and custody arrangements for crypto-asset service providers. In the meantime, Treasury asks for submissions on whether any particular crypto asset service arrangements should be specifically included in the definition of financial products to either:

-

- provide guidance on how those arrangements fall within the general definition of a financial product (i.e. by being a facility for making a financial investment, managing financial risks or making a non-cash payment); or

- add products that presently fall outside the general definition of a financial product.

- Public smart contracts: The Treasury’s taxonomy maps crypto products to the Australian financial services regulatory framework. That mapping against the existing framework is theoretically feasible for a large portion of the crypto ecosystem, which comprises of intermediated token systems. However, Treasury recognises that in the (presently relatively small) portion of the crypto ecosystem where “functions are truly being ensured by public, self-serve software” a fundamentally different approach may be required. Submissions are sought on this.

- Products with clear non-financial functions: The Treasury Paper acknowledges that there are portions of the crypto ecosystem that involve products which have clear non-financial functions. These include crypto tokens used for document provenance, digital identity, general record-keeping, document storage and crypto assets used in event ticketing. Businesses whose products (or planned products) have clear non-financial functions should make submissions seeking to draw the clearest possible bright line to ensure those products are outside the Australian financial services regulatory perimeter.

Queries

If you have any questions about this article, or require assistance in making a submission to Treasury, please get in touch with an author or any member of our Fintech, Privacy & Emerging Technologies team.

Disclaimer

This information and the contents of this publication, current as at the date of publication, is general in nature to offer assistance to Cornwalls’ clients, prospective clients and stakeholders, and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.